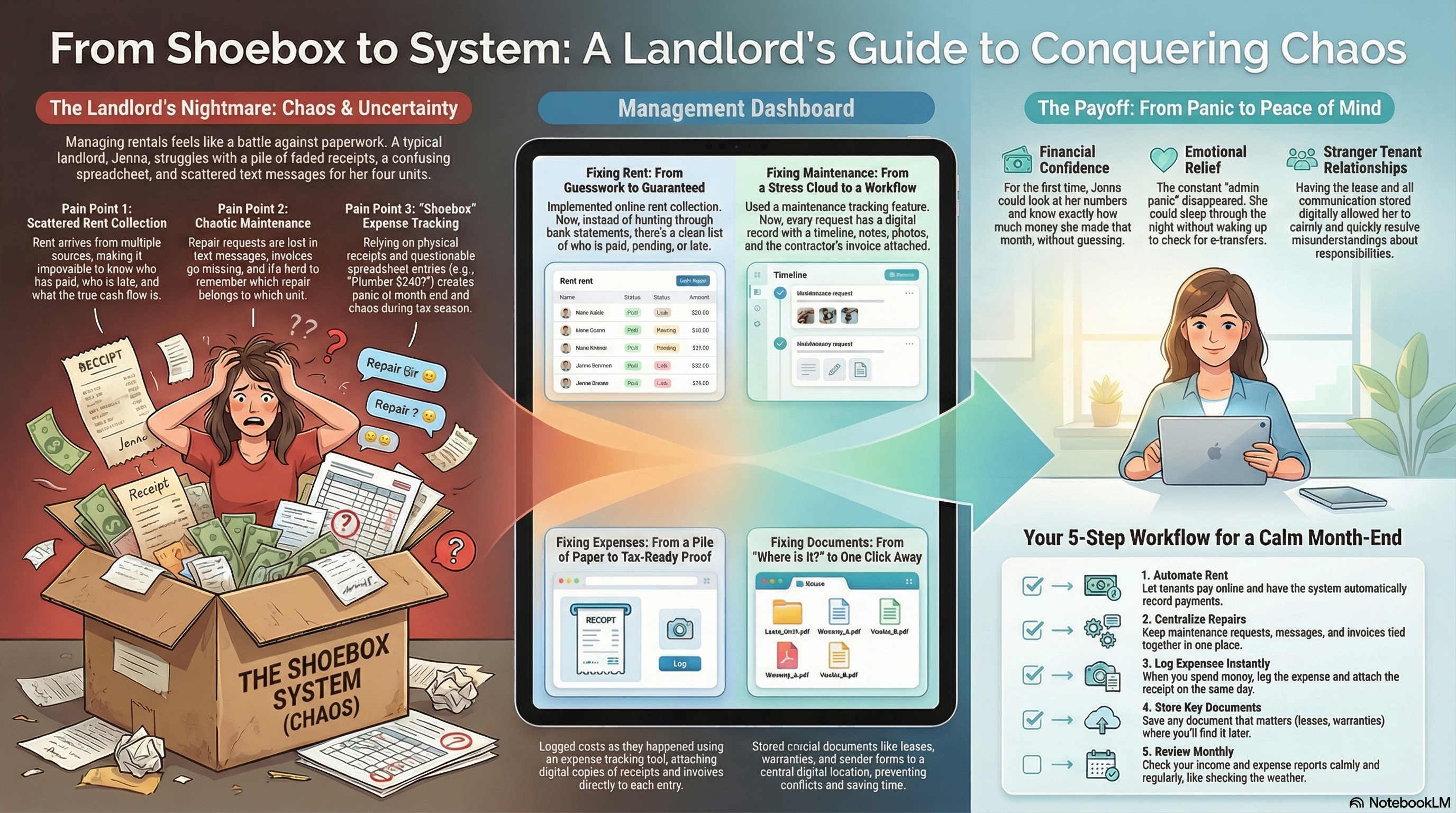

Rental Property Expense Tracking: A Landlord’s Story of Receipts, Repairs, and Relief

Jenna swore she’d stay organized this year.

It was a Tuesday night, the kind where the kitchen light feels too bright and the sink smells faintly like lemon dish soap. Her laptop hummed on the table. A mug of tea went cold beside a pile of paper receipts that looked like they’d been through a small war.

She managed four units across Canada and the U.S. Not a huge portfolio. Just enough to make “I’ll do it later” turn into “Why is this happening to me?”

Her phone buzzed.

Tenant: “Hey Jenna, the bathroom fan is making a grinding noise again.”

Jenna stared at the message, then at the receipts.

Three problems. All at once.

Rent came in from three different places, and she was never 100% sure what was paid and what was “paid-ish.”

Maintenance was a blur of texts, invoices, and half-remembered promises.

And the big one: rental property expense tracking was basically a shoebox system with better Wi‑Fi.

(If you’ve ever tried to read a faded receipt at midnight, you know the particular kind of rage it unlocks.)

The month-end moment when rental property expense tracking gets real

The tension always hit at month-end.

Jenna would open her spreadsheet and feel that tiny spike of panic. A line item would say “Plumber $240?” with a question mark like a shrug. Somewhere, there was also a $19.47 hardware store charge that might’ve been for the rental. Or might’ve been for her own leaky faucet. Who could say.

Then tax season would loom, and she’d start doing math like it was a survival skill.

In both Canada and the U.S., landlords are generally expected to keep records to support income and expense reporting, including receipts and invoices for deductions and claims.[1][2] The rule is simple. The practice is not.

Jenna tried a new system every January.

A folder labeled “RENTAL 2025,” which became a folder labeled “RENTAL 2025 (MESS).”

Emailing receipts to herself (which worked until her inbox became its own landfill).

A notes app list called “Expenses,” which ended at item #7.

That night, she opened a crumpled receipt and caught a whiff of gasoline. It was from a last-minute trip to pick up a smoke detector.

She whispered, “I can’t do another year like this.”

Her friend Malik, also a landlord, had been texting her about the same thing for weeks.

Malik: “You still doing the spreadsheet thing?”

Jenna: “Don’t judge me.”

Malik: “I’m not. I’m rescuing you. Try RentMouse.”

She’d heard of it. A landlord management app that helps you manage tenants, collect rent, track maintenance, and stay organized. She just hadn’t made the leap.

Tonight, she did.

Pain point #1: “Where did the rent go?” and the fix that makes it boring

The first thing Jenna tackled wasn’t receipts.

It was rent.

Because when rent collection is scattered, expense tracking becomes a guessing game. You can’t confidently see profit, cash flow, or what’s available for repairs.

She set up online payments through RentMouse using the rent collection tools. The change was immediate.

Not dramatic. Better.

No more “Did you send it?” messages. No more scrolling through bank transactions trying to match names to units. Rent became a clean list: paid, pending, late.

And the emotional benefit surprised her.

She slept.

(Like, actual sleep. Not the “I woke up at 3 a.m. to check e-transfers” kind.)

She also noticed something else: when rent was organized, she could finally think clearly about the rest of the business.

Pain point #2: Maintenance chaos that turns into financial chaos

The next morning, Jenna replied to the tenant about the bathroom fan.

Jenna: “Thanks for the heads-up. Can you submit it as a maintenance request so I can track it properly?”

She felt a little guilty saying it. Like she was being overly “process-y.”

But when the tenant submitted the request, it landed neatly in RentMouse through the maintenance tracking feature.

Now the grinding fan wasn’t just a text message floating in the void.

It had a record.

A timeline. Notes. Photos. And later, when the contractor emailed an invoice, Jenna attached it to the request.

Here’s what changed for her rental property expense tracking:

She stopped losing invoices.

She stopped forgetting which repair belonged to which unit.

She stopped paying the same vendor twice because she couldn’t find proof of payment.

Maintenance stopped being a stress cloud and became a workflow.

Pain point #3: Receipts everywhere, and nothing tax-ready

A week later, Jenna sat down to reconcile expenses.

The old way: open spreadsheet, open bank app, open email, open receipt pile, sigh, repeat.

The new way: she used RentMouse expense tracking to log costs as they happened.

One receipt at a time.

Quick entries. Clear categories. Notes that actually made sense later.

She added:

HVAC service invoice

Smoke detector purchase

Contractor labor for the fan replacement

Then she attached the digital copies.

No more “Where did I put that?”

Because she didn’t have to put it anywhere.

She also started saving key paperwork in one place with document storage. The vendor W-9 equivalent requests, warranty PDFs, inspection photos, and that one oddly important email thread about a replacement part.

Everything stopped being fragile.

It was backed by a system.

(And yes, she still kept a small folder for originals. But it stopped being the main plan. Big difference.)

The small detail that prevented the next argument

Mid-month, the tenant messaged again.

Tenant: “Just checking, are we responsible for the fan repair? It’s kind of old.”

Jenna felt the familiar heat rise in her chest. Not anger. More like that tight feeling of a misunderstanding about to become a conflict.

She opened the lease.

Not the paper copy. Not the PDF she couldn’t find last time.

The lease record in RentMouse, stored and organized through lease management.

She reviewed the maintenance responsibilities section and replied calmly.

Jenna: “Thanks for checking. This one’s on me as the owner. I’ve got it scheduled.”

It was a tiny moment.

But it mattered.

Because clear documentation doesn’t just help at tax time. It helps in the everyday moments where relationships can fray.

The numbers finally told the truth

At the end of the month, Jenna did something she hadn’t done in a long time.

She looked at her rentals and felt confident.

Rent was collected and recorded.

Maintenance had a history.

Expenses were categorized and attached to real documentation.

And for the first time, she could answer the question that used to make her squirm:

“Did I actually make money this month?”

She didn’t have to guess.

Her rental property expense tracking was no longer a pile of maybes.

It was a ledger she trusted.

A quick, realistic workflow you can steal from Jenna

Jenna’s new routine wasn’t complicated. That was the point.

When rent is due: let tenants pay online and let the system record it.

When something breaks: keep the request, messages, and invoice tied together.

When money goes out: log the expense the same day, attach the receipt.

When a document matters: store it where you’ll find it later.

Once a month: review income and expenses like you’re checking the weather. Calmly. Regularly.

She still had landlord moments.

A late-night call. A surprise repair. A tenant who didn’t read the email (classic).

But the admin panic? Gone.

Rental property expense tracking, near the finish line

Two months later, Jenna met Malik for coffee. The cafe smelled like espresso and warm cinnamon, and her phone stayed face down on the table the whole time.

Malik: “So. Still drowning in receipts?”

Jenna laughed. A real laugh.

Jenna: “Nope. RentMouse made it boring.”

That was the win.

Because rental property expense tracking shouldn’t feel like a second job. It should feel like a quiet, reliable habit that protects your income and your time.

If you’re staring at a shoebox, a spreadsheet, or an inbox full of vendor emails, there’s a cleaner way to run this.

CTA: Start a RentMouse trial and set up rent collection, maintenance, and expense tracking so your next month-end feels calm, not chaotic.

Sources

Landlords should confirm recordkeeping and deduction rules for their specific jurisdiction.

[1] IRS, "Publication 527: Residential Rental Property (Including Rental of Vacation Homes)" https://www.irs.gov/publications/p527

[2] Canada Revenue Agency, "Rental income" https://www.canada.ca/en/revenue-agency/services/forms-publications/publications/t4036/rental-income.html

[3] Canada Revenue Agency, "Keeping records" https://www.canada.ca/en/revenue-agency/services/tax/businesses/small-businesses-self-employed-income/keeping-records.html

[4] IRS, "Recordkeeping" https://www.irs.gov/businesses/small-businesses-self-employed/recordkeeping

Test Your Knowledge! 🎯

Question 1 of 5