1. Introduction: Beyond the Headlines

Walk through Toronto’s Entertainment District or Vancouver’s Coal Harbour today and the narrative seems written in neon: "For Sale" signs sit stagnant, and the "doom and gloom" headlines regarding the condo market have become a repetitive loop. For the casual observer, the Canadian housing market looks like a sector in retreat.

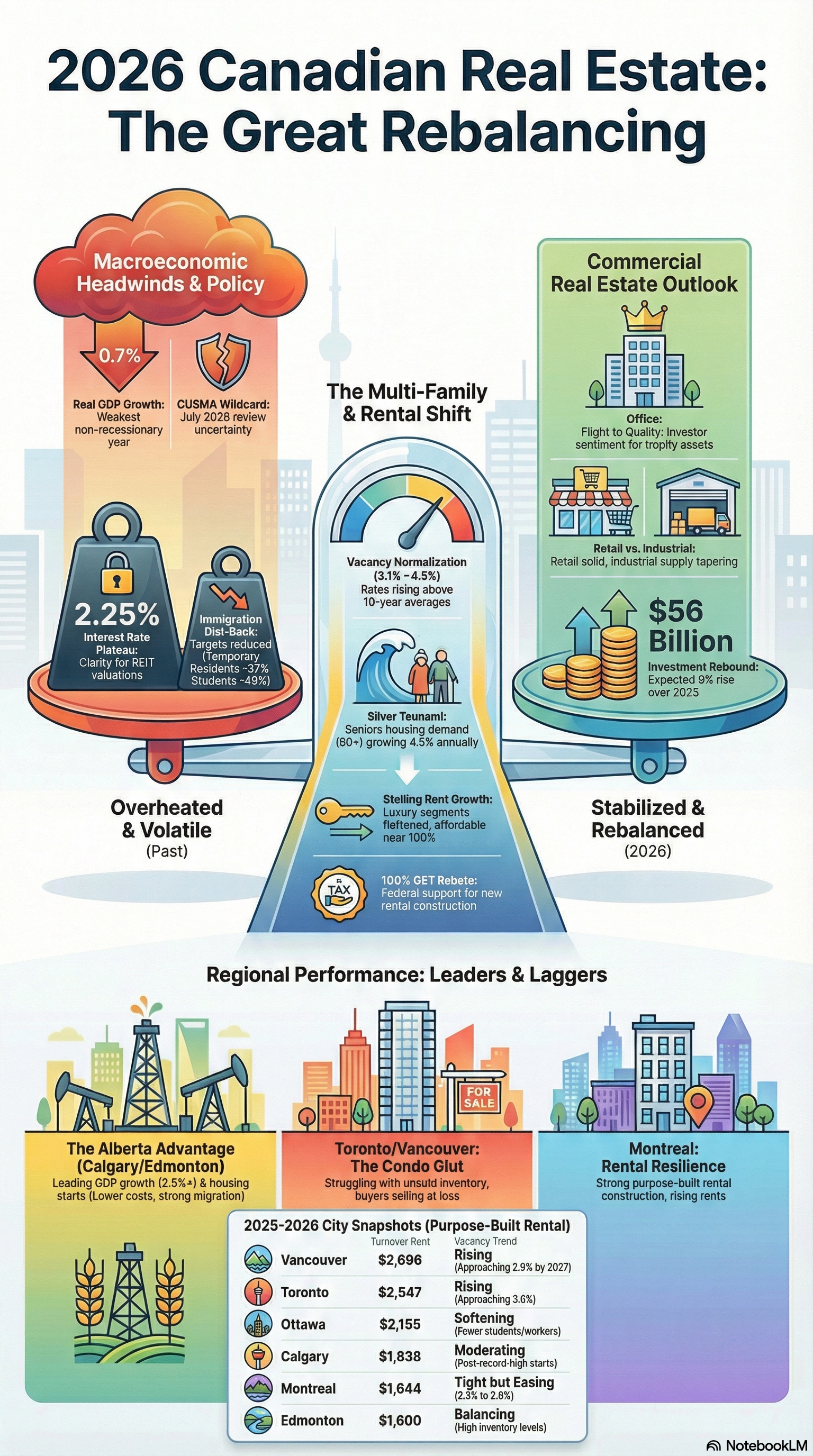

However, if you follow the "smart money," a different story emerges. While the traditional residential market navigates a painful reset, 2026 is revealing itself as a year of strategic momentum. We are seeing a profound rebalancing where sophisticated investors are looking past the transient noise to find assets backed by deep structural demand. From a $56 billion commercial resurgence to the demographic inevitability of seniors housing, this article distills the high-value insights defining the "intelligent investment" landscape of 2026.

2. The "Silver Tsunami" is Here: The Seniors Housing Surge

The math behind the "Silver Tsunami" is as relentless as it is lucrative. As the leading edge of the Baby Boomer generation turns 80 in 2026, the demand for seniors housing has transitioned from a distant demographic projection to an immediate market imbalance.

The structural gap is staggering: new seniors housing supply is growing at a mere 1% annually, while demand is surging at 4.8%. This sector is arguably the most "recession-proof" asset class in Canada today, driven by biological necessity rather than discretionary income. For institutional giants like Chartwell and Sienna, this represents a multi-decade tailwind.

Furthermore, high construction costs and interest rates have created a "protective moat" for existing operators. Because new projects are often only financially viable at rents significantly higher than what is currently achievable, current asset owners are insulated from new competition.

"New seniors housing construction represents only 1% annual growth while demand surges at 4.8% annually. This structural imbalance creates a multi-decade tailwind for existing operators... creating a widening gap between supply and demand." — MMCG / REIT Market Outlook

3. The $56 Billion Rebound: Commercial Real Estate’s Surprising Comeback

While the "dead" condo market captures the headlines, the commercial sector is staging a recovery that few predicted. CBRE forecasts that total commercial investment—spanning industrial, retail, multifamily, and stabilized office assets—could hit $56 billion in 2026. This would represent an 8% rise in property sales volume over 2025 and rank as the third-highest total in Canadian history.

This is a classic "flight to quality." Global investors are viewing Canada as a "safe haven" amid geopolitical volatility and trade uncertainties. The rebound is focused on stabilized assets with strong fundamentals, signaling that international capital is prioritizing long-term resilience over short-term volatility.

As CBRE Canada President and CEO Jon Ramscar puts it: "International capital has already voted in favour of Canadian commercial real estate. We have seen assets purchased across the country due to our strong fundamentals and relative stability."

4. The Great Rental Rebalancing: Why "Breathing Room" is a Double-Edged Sword

The rental market has finally moved past the "overheated" era of 2022–2024. National vacancy rates have eased to 3.1% as of late 2025, though institutional forecasts suggest they could peak between 3.9% and 4.3% in 2026. This provides much-needed "breathing room" for tenants, but it is a double-edged sword for landlords.

We are seeing a "filtering effect." A surge of new luxury supply in Toronto and Vancouver is forcing landlords to offer incentives—such as free rent months—to maintain occupancy. Simultaneously, federal policy shifts reducing the number of international students and non-permanent residents are cooling demand in urban cores.

It is critical to distinguish between "in-place" rents (what long-term tenants pay) and "turnover" rents (the cost of a new lease). While overall rent growth is slowing, the cost of moving remains high, particularly in the Prairies where demand continues to outpace supply.

City | 2-Bedroom Turnover Rent (2025/26) |

Vancouver | $2,696 |

Toronto | $2,547 |

Montreal | $1,644 |

Calgary | $1,836 |

Edmonton | $1,600 |

5. Scarcity as a Superpower: The Defensive Moat of Regulatory Hurdles

One of the most counterintuitive insights for 2026 is that Canada’s high development barriers are actually a benefit for existing asset owners. The "Defensive Moat" created by restrictive planning, long approval timelines, and high construction costs makes current properties exceptionally defensible.

For institutional investors, these hurdles ensure that new supply cannot easily flood the market and erode value. While the federal GST removal on new rental construction was a helpful tactical shift for project viability, the overall environment remains one of extreme scarcity. For those few who can navigate the bureaucracy to build, they find themselves with a "clean slate"—launching new products into a market with almost no direct competition.

6. The Prairie Powerhouse: Why Capital is Moving West

A tectonic regional shift is currently underway. While the Toronto condo market is being described by many analysts as "dead"—struggling with record-high inventory and paralyzed presales—the Prairies are surging.

Calgary is officially the "top market to watch" for 2026. With real GDP growth forecast at 2.6%, it leads all major Canadian cities. This "Alberta boom" is attracting REITs like Boardwalk, who benefit from a lack of provincial rent control and can capture market rent increases in real-time. In contrast to the coastal hubs, Calgary and Edmonton are seeing record-high housing starts, fueled by affordable entry points and a more sustainable link between housing costs and local incomes.

7. Conclusion: Navigating the 2026 Fog

As we move through the "fog" of 2026, the market is clearly rewarding those who can distinguish between cyclical noise and structural truth. We have moved past the era of "panic" into a period of "Intelligent Investment."

The transition from uncertainty to momentum is bifurcated: if you are holding a portfolio of "what used to work"—primarily over-leveraged urban condos—the outlook remains challenging. However, if you are positioned to capitalize on the scarcity value of existing assets, the demographic surge in seniors housing, or the economic dynamism of the Prairies, the opportunities have never been clearer.

The question for the sophisticated investor is no longer whether the market will recover, but rather: Are you viewing current supply constraints as a barrier to your growth, or as the defensive moat that protects your future yield?

In a challenging rental market like Canada’s 2026 reset, where landlords are facing rising vacancies, tougher tenant expectations, and more competitive pricing, RentMouse – Free Property Management Software for Landlords can be a practical lifeline for independent and small-portfolio owners. RentMouse centralizes all key tasks — from tenant screening and digital lease creation to online rent collection and maintenance tracking — into one intuitive dashboard, reducing administrative burden and helping landlords stay organized and compliant with local laws (including Alberta specific requirements). By automating routine communication, tracking payments in real time, and generating professional lease documents with e-signatures, it frees up time that many small landlords would otherwise spend chasing checks or juggling spreadsheets. Having these tools in place not only improves operational efficiency but also enhances the tenant experience — which can be crucial for maintaining occupancy and cash flow during periods of market softness.

Test Your Knowledge! 🎯

Question 1 of 5