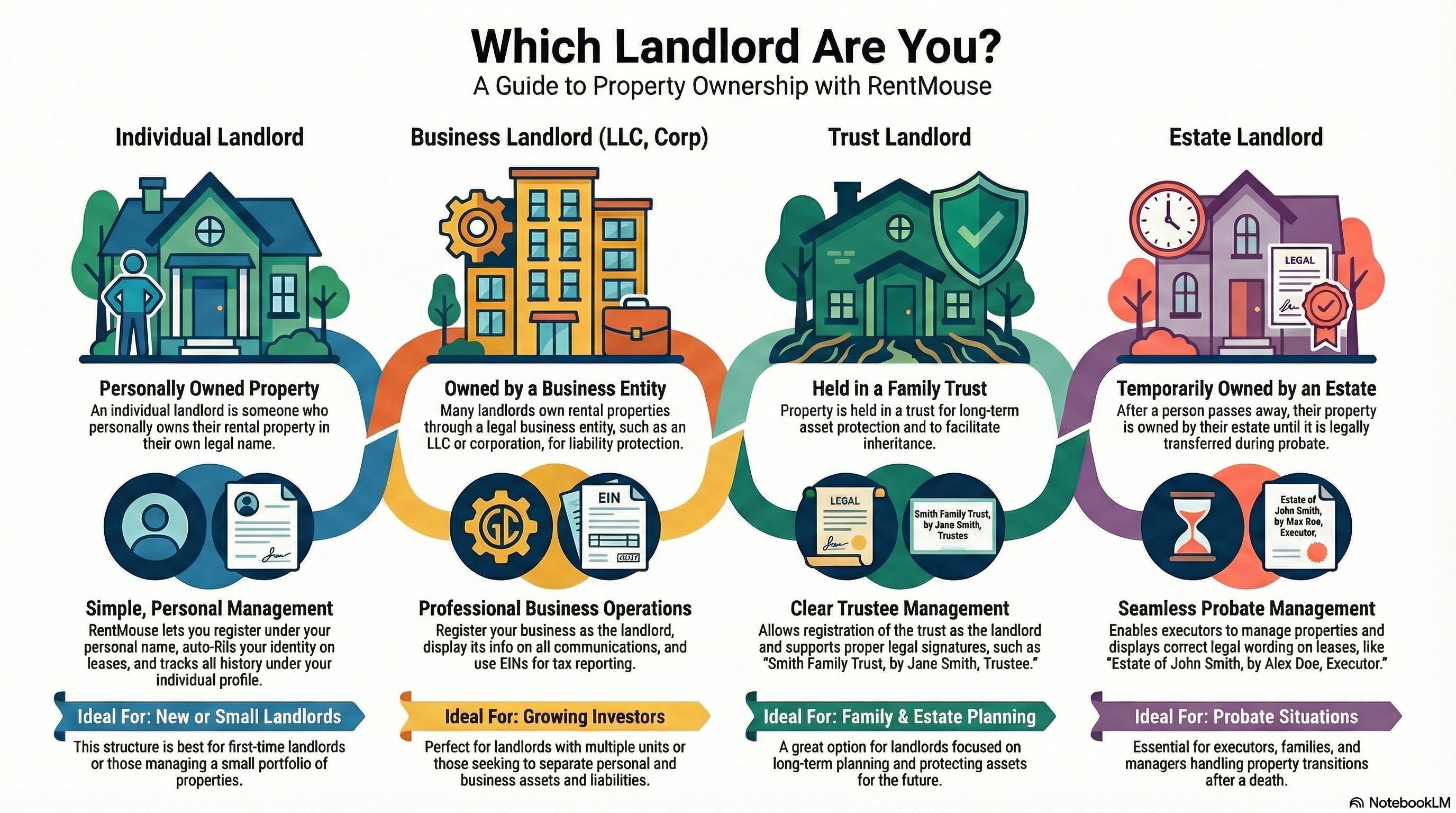

RentMouse is designed for real landlords with real properties—no matter how those properties are legally owned. In Canada and the United States, rental homes can be owned by an individual, a business entity, a trust, or an estate. RentMouse supports all these ownership structures, helping landlords stay organized, compliant, and professional.

Below is a clear breakdown of what each ownership type means and how RentMouse helps you manage it.

Individual Landlords on RentMouse

An individual landlord is someone who personally owns their rental property.

What RentMouse Does for You

Lets you register under your personal legal name

Auto-fills your landlord identity on leases and receipts

Tracks payments and history under your individual profile

Ideal for first-time landlords or small portfolios.

Business Landlords (LLC, Corp) on RentMouse

Many landlords prefer to own rental properties through a business, such as an LLC or corporation.

How RentMouse Supports You

Let’s you register your LLC/corporation as the legal landlord

Displays business information on all leases and tenant communications

Supports EINs and business tax reporting needs

Keeps business and personal properties separate

Perfect for landlords with multiple units or those wanting additional liability protection.

Trust Landlords on RentMouse

Some landlords hold property in a family trust for inheritance and asset protection.

How RentMouse Helps

Allows registration of a trust with the trustee’s name

Displays the trust (not the individual) as the legal landlord

Supports proper lease signatures such as

“Smith Family Trust, by Jane Smith, Trustee”

Keeps trust-owned properties clearly separate from others

A great option for long-term planning and estate protection.

Estate Landlords on RentMouse

When someone passes away, their property is temporarily owned by their estate until it is legally transferred.

RentMouse Features for Estates

Allows executors to register and manage properties under the estate

Displays proper legal wording on leases (e.g.,

“Estate of John Smith, by Alex Doe, Executor”)

Helps maintain rental operations during probate

Useful for executors, families, and property managers handling estate transitions.

Which Landlord Type Is Best for You on RentMouse?

Ownership Type | How RentMouse Supports It | Best For |

|---|---|---|

Individual | Simple setup, clean personal tracking | New or small landlords |

Business | Business name, EIN, receipts, entity-level control | Growing investors |

Trust | Trustee-based signatures, trust record-keeping | Family & estate planning |

Estate | Executor signatures, temporary ownership | Probate situations |

Final Thoughts

Understanding the differences between individual, business, trust, and estate ownership helps landlords make smarter decisions about legal structure, taxes, and long-term planning. It also gives tenants clarity about who is responsible for the property.

No single structure is “best” for everyone—each offers unique benefits and responsibilities. Before choosing an ownership structure, many landlords consult a legal or tax professional to ensure they’re making the most strategic choice for their goals.